Seen through a global lens, achieving Net Zero by 2050 requires considering critical questions about how efforts should differ according to country, sector and corporation. This article highlights key findings from ENGIE Impact’s Net Zero Corporate Readiness Report – based on our survey of 400 business leaders representing 21 sectors across 23 countries, including a deeper dive into the consumer goods industry.

About the Net Zero Corporate Readiness Survey

What we set out to learn:

- Businesses are upbeat and optimistic about their sustainability programs and abilities, yet …

- The fundamentals necessary to enable that transformation – the decarbonization enablers – are not yet in place.

- What is the reason for the disconnect?

How we gathered information:

- Surveyed 400 business leaders responsible for sustainability initiatives at their organizations

- Included leaders across 23 countries, representing companies with more than $1 billion (USD) in revenues or more than 10,000 employees

- Asked various questions and gave respondents a five-point scale ranging from “Strongly disagree” to “Strongly agree.”

What we discovered:

- Carbon and emissions data are not influencing corporate governance and business decisions

- Strategic planning is not translating into real-world execution, deployment or financing

- Data, resources and mobilization are all decentralized

Key Insights

Carbon and emissions data are not influencing corporate governance and business decisions

With the pressure to decarbonize at an all-time high, now is the time for companies to leverage experts and digital tools to fundamentally shift the way they capture, analyze and model data to enable globally aligned, carbon-first decision making and maximize the impact of market-responsive investments.

Yet, survey findings reveal that business decisions remain disconnected from emissions data.

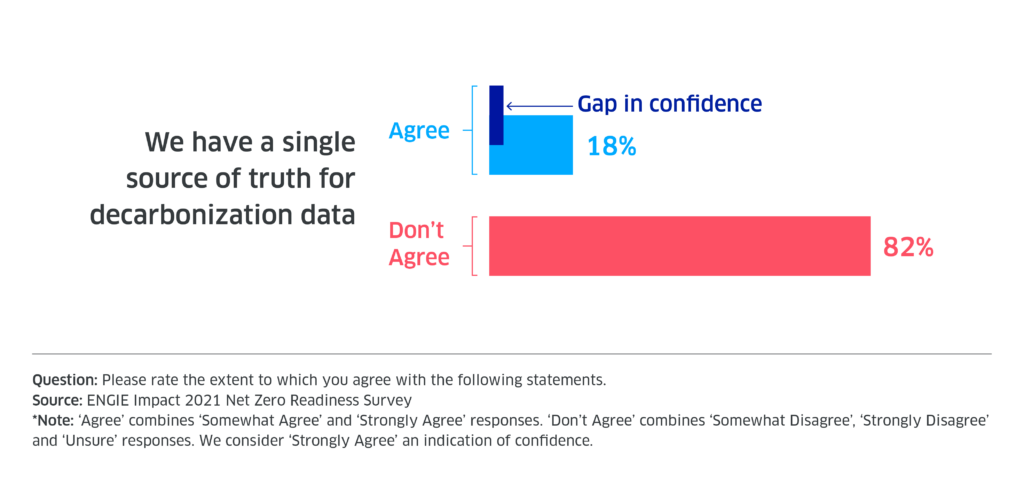

Less than a quarter of business leaders believe they have a single source of data. When we zoomed in on the strength of agreement, there was a sharp decline in confidence – as well as a considerable gap in perceptions of that of the C-level compared to their direct reports.

Zooming in on the Global Consumer Goods industry:

Companies are faced with uncertainty, scarcity and complexity in a resource-intensive industry that drives high emissions across the value chain. There is a growing urgency to build a credible baseline to drive impactful decarbonization, making it imperative for businesses to have a central and up-to-date view of their total footprint, including emissions from their own operations and value chain (Scopes 1, 2 and 3).

Strategic planning is not translating into real-world execution, deployment or financing

Decarbonization is a complex undertaking in a rapidly changing technological and regulatory landscape. Therefore, companies are making certain their ambitions are supported by a roadmap that provides a blueprint for execution and identifies the relevant levers and business models to ensure the strategy is future-proof.

Even then, the survey shows that companies’ confidence in their decarbonization technologies strategy declines as they move from planning to execution.

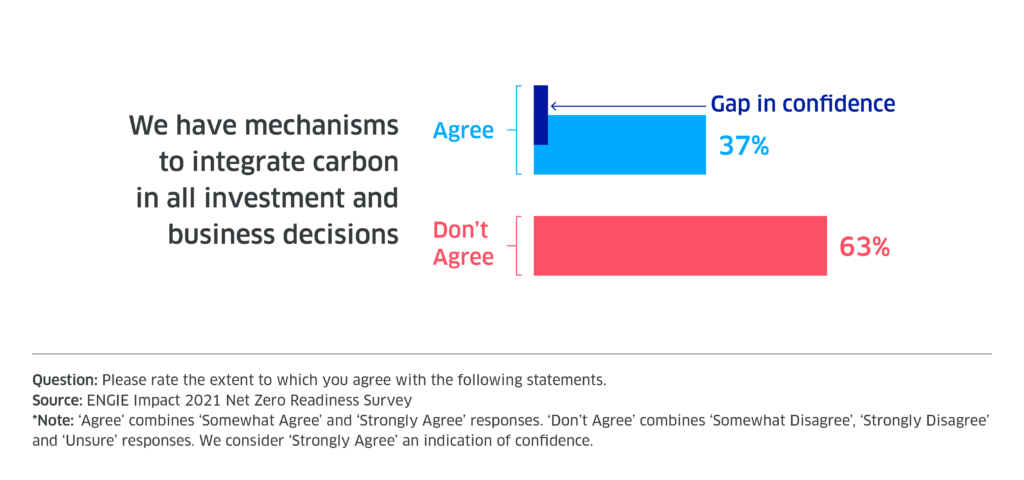

A strong majority of business leaders indicate their companies fail to understand the relevant technologies, whether what they choose will suit their future business plans and what it all will cost. They are uncertain as to whether they have the mechanisms to integrate carbon in their investment and business decisions. Remarkably few have confidence in their companies’ ability to execute their strategic decarbonization plan.

Zooming in on the Global Consumer Goods industry:

The consumer goods industry is among the leaders in terms of taking sustainability into account, but it also receives much greater consumer scrutiny than other major industries. As is well known, consumer expectations are changing toward greater awareness of sustainable products, as are those of the regulatory bodies. There is a real need for concrete solutions, particularly when it comes to decarbonizing highly complex supply chains (Scope 3 emissions).

Data, resources and mobilization are all decentralized

Having an ambitious corporate vision to become a sustainable organization is a necessary but not sufficient condition for successfully enabling a Net Zero transformation. Pledges made at the top of the corporate ladder cannot be expected to trickle down through a company. They must be activated at the local level, site by site and across business units, by equipping people with carbon data insights and the resources to leverage them. This happens less often than it should.

As a result, corporate and local offices are not coordinating on decarbonization.

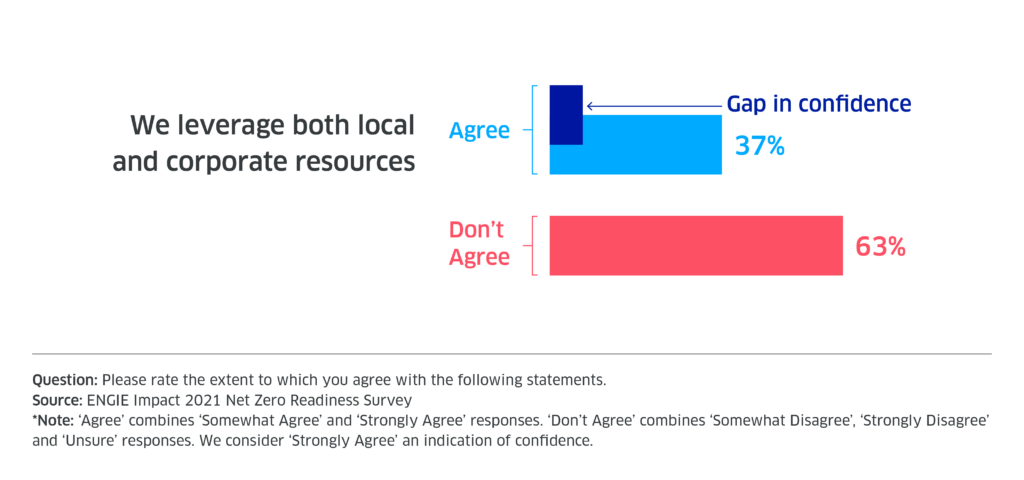

Just over one-third of business leaders agree they can leverage local as well as corporate resources to drive decarbonization across operations, and even fewer department directors see sufficient coordination between corporate and local offices. Again, the percentage of those who believe they can successfully streamline the local and corporate levels decreases significantly when asked whether they are confident (or “strongly agree”) that this coordination is happening.

Companies are facing growing pressure to better manage resources, achieve greater transparency for stakeholders and keep expenditures low. The spectacular growth of the consumer goods industry across channels and geographies raises significant challenges to keeping local entities aligned with corporate goals. Entire organizations must be mobilized to streamline decarbonization efforts across operations.

Businesses Must Strengthen the Enablers of Net Zero Transformation

With politicians increasingly vocal about the climate imperative, policymakers ratcheting up carbon-cutting ambitions, and stakeholders demanding faster progress, this is a transformative moment for business. As members of a more directly consumer-facing industry, consumer goods companies are under pressure to respond to rising societal demands for sustainable production and transparent supply chains. Consumers want companies to own their carbon transition and make it central to their business operations rather than view sustainability as merely a reporting obligation.

Business leaders know that committed execution of decarbonization strategies will create a real competitive advantage in their industry, yet most companies are not ready for Net Zero transformation. While upbeat about their decarbonization initiatives, they continue to underestimate the magnitude of change required.

It is therefore imperative that companies increase investments in the critical enablers of decarbonization. They need an actionable and cost-effective decarbonization plan that firmly connects decision-making with carbon and emissions data. They should avail themselves of expertise to ensure that investments in technologies today are efficacious years down the road, and they must streamline their organization to leverage local as well as corporate resources to drive decarbonization across operations.