If there is something important the COVID-19 pandemic has reminded us of, it is that many things are more valuable than money. Perhaps this shouldn’t surprise anyone. For example, the economic principle that states that scarcity of something leads to higher prices doesn’t make much sense when the item is health, water or access to food on shelves. Likewise, to Generation Z climate crisis protesters, measures such as Gross Margin, EBIT and NPV seem disconnected from their worldview.

Value is a tricky term to nail down, as it varies with context. Investors might think in terms of total shareholder value, project managers in terms of Return on Investment, and salespeople in terms of gross margin. Yet none of these seem to fully capture ongoing changes in consumer goods value-chains and in wider society. There is a risk that by pursuing simplistic, profit maximising strategies, companies neglect the broader options to create value for all stakeholders.

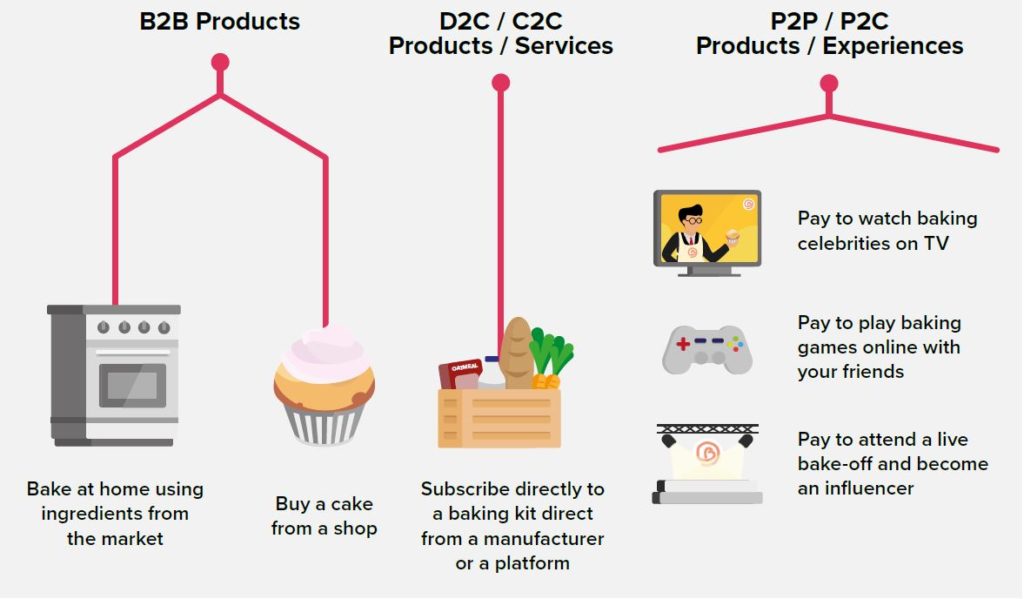

When our industry started to flourish in the 19th Century, the equation was straightforward: make something, add a margin and sell it at a profit to a wholesaler or retailer who in turn add their margins. The classic Business-to-Business (B2B) model, and a neat fit with the economics of John Maynard Keynes and the supply and demand curves of William Jevons. Ideas such as brand equity started to muddy the water, but more systemic change in the meaning of value has been underway for some time as consumer goods businesses have diversified away from B2B to business-to-consumer, subscriptions and other business models. The media industry has become more directly involved in the business of demand and supply. The old equation isn’t enough when there are so many stakeholders in the value network and when so much of the equation depends on intangibles.

None of this means that we should abandon old-fashioned financial management, but it has got more complex to understand if we are delivering value or not. Imagine the scenario where product placement in a global game and movie franchise is a significant goal for a brand. How does the Chief Supply Chain Officer approach optimising resources and assets to match the vagaries of these notoriously unpredictable businesses and their influencers? How do trade fund negotiations proceed between retailers and manufacturers when there is so much uncertainty of how the value equation will play out? Who gets what margin, when?

And the economic and societal context is changing. The ideas of Keynes gave way to Milton Friedman, and now multi-stakeholder approaches such as Doughnut Economics are on the rise to “meet the needs of all within the means of the planet” (quoting so-called “renegade economist” Kate Raworth of Oxford University). In my own research on Generation Z and their younger siblings for the University of the Creative Arts Centre for Sustainable Design, there is a growing belief that many businesses in our industry do not fully account for the cost and impact of doing business, and do not have a value equation that is sustainable in the long term without irreversible harm to planetary systems. Hence, we have flourishing B Corporations and a growing body of work on “brand hate.”

How do the Board views these changes? CFOs have long recognised the difference between Economic Profit and Accounting Profit: maximising cash-flow and minimising cost of capital becoming additional determinants of success. Even before diversification of business models is factored in, this is still a “single bottom line” approach that sits uneasily with contemporary perspectives on macroeconomics and “triple bottom line” ideas. A value equation that spans contributions to environmental health, social well-being, and a more equitable economy introduces more of those tricky intangibles for the value equation and for decision makers.

Where does all this lead? Currently, our industry is still in the early stages of assimilating these ideas, just as we are adapting to the notion of value chains becoming value networks or “a loosely coupled system” and so the older notions such as return on capital employed are not going anywhere soon. But the direction of (accounting and economic) travel is getting clearer, despite some of these newer ideas remaining divisive amongst economists and accountants.

So what should we be doing now? Here’s the paradox: acting to maximise the interests of our own company is natural, but that does not mean we will maximise the value in our increasingly complex, multi-stakeholder value chains. Just as we are developing more sophisticated business models, collaborations and alliances for both supply and demand, we need to incorporate what happens beyond our organizational boundaries into our value equation. Only then can we incentivise behaviour that will lead to long-term success in the New Normal.

Find out more:

Join the Open [ ] Space meetings with Dr. Trevor Davis on 20th, 27th October and 3rd November 2021.