Keeping produce cold is a fundamental part of food retailing. Yet often we inherit refrigeration systems without questioning whether they’re really the best cooling solution. Retailers know that maintaining low temperatures requires high levels of energy consumption, among other operational considerations. Although this makes them generally open to considering alternatives, when it comes to actually implementing changes that break with old habits we still have a long way to go.

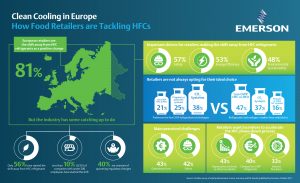

Recently there have been an increasing number of conversations about refrigeration systems that use HFCs – an environmentally harmful gas used in most of our cooling systems. While more than 80 percent of French, German and UK retailers believe that regulations phasing-down the use of HFCs would be good for their business, only 56 percent of retailers have actually begun to move towards using lower global warming potential alternatives.

And there is a good reason why retailers should reconsider their HFC refrigeration systems sooner rather than later. In October 2016, The Consumer Goods Forum (CGF) announced its second resolution on refrigeration, continuing the phase-out and calling for the inclusion of HFCs in the Montreal Protocol. UN representatives gathered in Kigali and agreed to phase-down the use of HFCs from 2019 as part of the Kigali Amendment to the Protocol. This agreement, combined with stringent EU regulations, means that HFCs will soon be in short supply.

While this is great for the environment, the reduction could prove more difficult for retailers if they don’t make the necessary preparations to shift to less harmful alternatives. In fact, 40 percent of retailers are still not fully aware of these new regulations, leaving them exposed to upcoming HFC shortages. The concern is that unprepared retailers may be forced to make a snap decision once HFCs become harder to get hold of, and as such choose a system that doesn’t make business sense.

For example, while retailers ranked CO2 as the most popular replacement for HFCs, choosing this option could actually prove to be more expensive in the long run. Higher maintenance costs mean that CO2 systems could cost a medium-sized retailer up to €51,000 more per store over a 10 year lifecycle compared to self-contained systems that use propane hydrocarbons.

That does not mean that retailers should be scared about the transition. Nor does it mean that CO2 isn’t a viable HFC alternative for some stores – the point we are making here is that we should view the upcoming HFC phase-down as a real opportunity to think holistically about cooling and carefully consider the best options available.

And in theory, retailers are aware of this too. Safety, energy efficiency and environmental sustainability rank as the top drivers for retailers looking into a new refrigeration system, demonstrating a willingness to think more broadly about the far-reaching benefits a new refrigeration system can have.

So What’s Stopping Them?

As a result, retailers could be missing out on a range of benefits – from lower service costs, to cheaper installation and operation, to less disruption – which could be gained by breaking from traditional system architectures. For example, moving to self-contained refrigeration systems could provide more flexibility and enable retailers to rethink their entire store layout to reflect demographic trends and seasonality.

When asked what would encourage them to quicken the pace of their transition, retailers said that depreciation schemes or other tax rebates would be the biggest incentives, followed by finding less expensive low global warming potential (GWP) options. From our point of view, this is a cry for more advice and support from regulatory bodies – and I’d wholeheartedly urge them to provide retailers with as much backing as possible as they start to make the shift.

Non-governmental organisations like the CGF are helping to fill the gap left by regulatory bodies and are powerful groups for encouraging retailers to grasp the transition with both hands. CGF members have taken the lead in implementing natural refrigerants on a global level – it’s this proactive stance that we should encourage and filter down to retailers everywhere.

Eric Winandy

Director of Integrated Solutions

Emerson Commercial & Residential Solutions